With the Australian Government's new $2.3 billion Household Battery Pledge slashing upfront costs of batteries by 30%, could 2025 be the year Tesla Powerwall batteries shift from an expensive green technology to a smart investment?

We crunch the numbers behind the hype to reveal whether jumping on the Tesla Powerwall battery bandwagon now is a financial win or a costly gamble.

In this comprehensive guide we are going to answer this question and also cover:

🧮 How Tesla Powerwall savings are generated;

💲 Is the Tesla Powerwall 3 worth it; and

🔮 The right time to buy a Tesla Powerwall 3.

➡️MORE: Tesla Powerwall 3 Launches in Australia With More Power and New Features

Get a Battery Quote Today!How a Tesla Powerwall 3 Battery Saves You Money

How Tesla batteries save you money

Like solar, consumers will have different reasons as to why they'll purchase a battery: energy independence, environmental and financial – with the latter the most difficult to decipher.

Batteries reduce your electricity bill by charging when energy is cheap and discharging when it is expensive. This is known as load shifting.

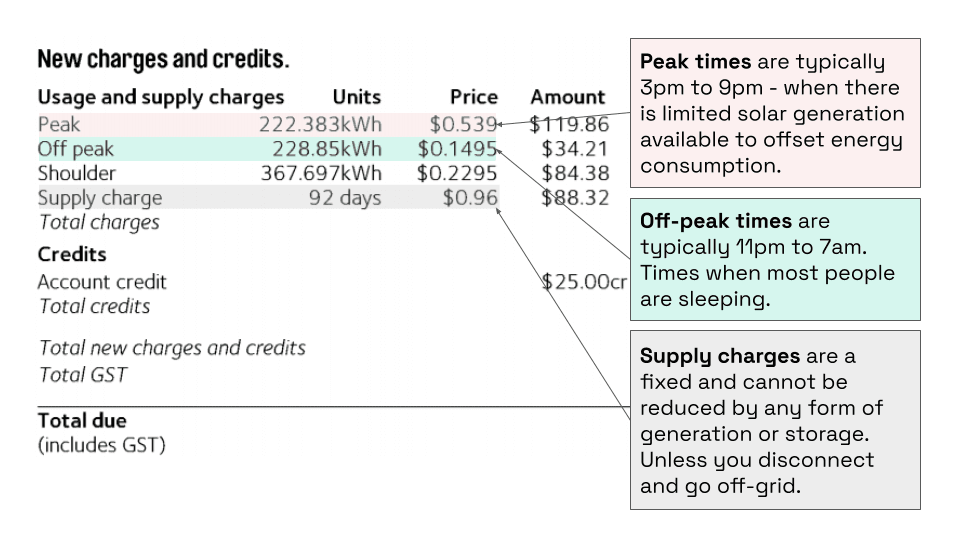

Figure 1 – AGL time of use electricity bill example

To demonstrate how load shifting works, we hopped onto the Energy Made Easy and chose a typical residential electricity time of use tariff plan - AGL's Residential Solar Savers plan (figure 1)

It comprises:

1. Supply charges (cost of getting electricity to your home); and

2. Usage charges (energy you consume).

Usage charges make up the significant majority of your electricity bill and are where solar and batteries have the most impact.

Batteries like the Tesla Powerwall 3 can be configured to charge when energy is cheap (off-peak or via solar which is notionally ‘free’) and discharge when energy is expensive (peak).

The more expensive the energy offset with the lowest cost of charging, the greater the Tesla Powerwall savings. For this reason, flat tariffs are unlikely to make financial sense under nearly any scenario.

The other key consideration when assessing the financial case for Tesla Powerwall 3 battery is the upfront cost.

This is important when assessing the payback period - the number of years for energy savings to repay the cost of the battery.

The case study below will look at the financial case for a solar and Tesla Powerwall 3 battery system by reviewing both the energy savings and total system costs.

Is a Tesla Powerwall 3 Battery Worth It?

One of the biggest concerns for homeowners considering Tesla home batteries is whether or not they are worth the investment. While the upfront cost of a Tesla Powerwall 3 can be high (~$16,000 installed), the energy savings could make it a worthwhile investment.

To illustrate whether a Tesla Powerwall 3 makes financial sense, we’ll look at a customer profile that best reflects:

1. The average energy user; and

2. A common system configuration.

In this case we've modeled the energy consumption (double peak) of a Sydney-based family comprising a working couple and two school-age children.

How a Tesla Powerwall 3 battery works

In this example (figure 3), the Tesla Powerwall 3 employs load shifting to reduce the electricity bill. The battery is primarily charged via solar, with off-peak grid charging used where it was economically sensible. Key ‘qualitative’ benefits generated by the system include the:

- Overall grid energy was reduced by 71% (refer figure 4 below)

- Almost all peak-hour load was eliminated with the remaining load being mainly early morning (off-peak)

- Carbon offset equates to taking 2.2 cars off the road annually

Analysing the financials: cost, savings and returns (ROI) of a Tesla Powerwall 3

The table below summarises the ideal scenario to maximise the financial case for a Tesla Powerwall 3 battery.

In assessing the financial case we elected to use a typical 7 kW solar system ($6,000 installed) and the 13.5 kWh Tesla Powerwall 3 ($13,600 before installation or $16,000 installed).

The stand-alone solar system is expected to generate $1,265 of savings in the first year, resulting in a payback period of 3.8 years (i.e. how long the electricity savings take to repay the upfront cost of the system).

Powerwall 3 Savings and Payback without Rebates

The Tesla Powerwall 3 battery is expected to generate $1,100 of savings in the first year, resulting in a payback period of over 15 years. This falls outside the 10-year warranty period and the expected 15-year operating life of the Tesla Powerwall 3.

The savings just from the Powerwall 3 battery are insufficient to recover the initial capital cost within its expected 15-year operating life.

The financial return on investment in this scenario is weak.

Powerwall 3 Savings and Payback with Rebates

If you are able to take advantage of the government's proposed 30% battery rebate, the return on investment improves substantially.

The Tesla Powerall 3 would cost $11,300, reducing the payback for the Powerwall 3 to 10.6 years. If combined with solar, this would reduce further to 7 years. This brings the payback period close to the 10-year warranty period.

As you can see the price of the Powerwall 3 battery is the most significant factor in your financial return on investment.

While the figures in this case study reflect a specific scenario, the analysis will be applicable in many residential use cases.

Higher system consumption, better financial returns

A key driver in maximising the financial returns of any solar and battery system is maximising self-consumption. Higher consumption will result in higher utilisation of the solar and battery system, resulting in higher bill savings and a faster payback period. The converse is true if consumption is lower - payback periods will be longer.

Another way of looking at financial returns

Does the Tesla Powerwall 3 make financial sense? It depends.

Another way of viewing the financial case for batteries is by comparing it to other types of common investments.

At current energy prices, the returns on a subsidised battery exceed the long term returns on all major asset classes. As energy prices continue to increase, this will improve the reltive returns a battery will generate.

From the numbers we are seeing, there

On a system basis (solar and battery) , the returns on a subsidised system exceed the long term returns on all major asset classes. As energy prices continue to increase, this will improve the relative returns a system will generate.

From the numbers we are seeing, there could be a financial case for refinancing your home to purchase a solar system, batteries, or both!

When viewed from this perspective, the case for purchasing a Tesla Powerwall 3 battery starts to look compelling. The possibility that the Powerwall 3 may not work beyond its warranty period or operational life should not be ignored.

Although the financial case for the Tesla Powerwall 3 heavily depends on whether subsidies exist, customers are increasingly making decisions on a more holistic basis, including recognising benefits such as backup power (for blackouts and outages) and reducing one’s carbon footprint.

How Much Does a Tesla Powerwall Battery Add to House Value?

How does a Tesla battery increase a home's value?

A Tesla home battery system can increase a home's value to the market in three ways:

1. They can substantially reduce a household's annual electricity bill. In the above example, the electricity bill was reduced by almost $2,000 per annum.

2. They can reduce your reliance on the grid and can be set up to provide backup power. The inconvenience and financial cost of a power outage can be significant.

3. Homes with solar battery systems installed will appeal to buyers who are becoming increasingly environmentally conscious. In the previous example, reliance on the grid was reduced by nearly 80%. In a survey conducted by Origin Energy, "57% of homeowners saying they would pay up to $10,000 more for a home equipped with solar, and 60% would pay at least that much more for a home with both".

How much does a Tesla battery add to a home's value?

Research from Domain reveals that the investment often pays off as homes with solar installed are valued on average $125,000 higher than those without. Given the average home solar battery system costs between $15,000 to $20,000, this is another financial reason to consider installing a Tesla battery system.

The Future of Tesla Batteries and Home Energy

Falling battery prices

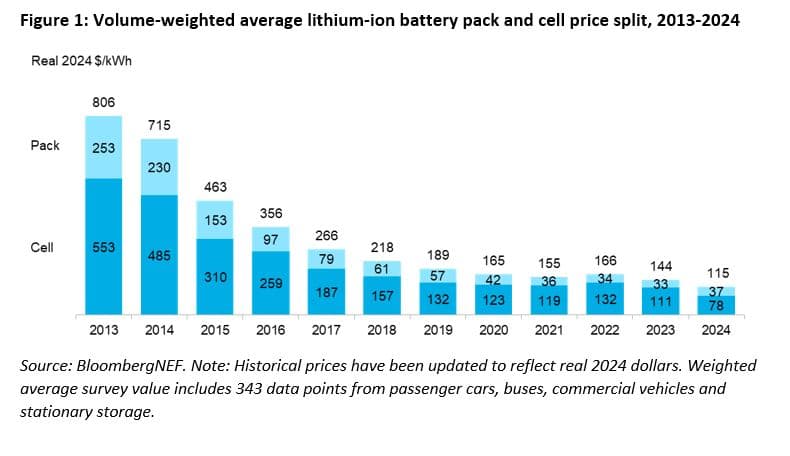

While the financial case for Tesla Powerall 3 is still challenging without rebates, further declines in battery prices should continue to push Tesla Powerall battery prices down.

Wholesale battery prices have fallen by as much as 89% in the last decade and will continue to fall.

The other key factor to consider is the increasing difference in off-peak and peak energy prices. As more solar generation powers the grid, this may have the affect of pushing down peak/shoulder energy prices but increasing peak prices (when the sun) isn't shining.

When is the right time to buy a Tesla Powewall 3?

It would be hard to recommend the Tesla Powerall 3, on a purely financial basis, without either a state, federal (ideally both) battery incentives.

If you can take advantage of these incentives however, the right time could be today.

Emerging alternatives

2025 is set to become the year V2H and V2G become a reality for Australian households, with several bidirectional chargers expected to launch later this year.

Bi-directional charging with EVs enables vehicle to the grid (V2G) services which in turn enable the use of your electric car to function as a battery storage system.

➡️MORE: When is V2G Really Coming to Australia? An Energy Insider's Take

This potentially provides the same utility value as a stationary battery.

Given electric vehicle batteries are three to five times larger than stationary batteries and the fact that cars remain unutilised 95 per cent of the time, it poses the question: would your money be better spent towards an EV?

In future stories, we will explore the emerging utility value of electric cars where they will provide services across transport, energy storage, and the electricity grid.

➡️MORE: Bidirectional (V2H and V2G) EV Chargers Guide (2025)

Frequently Asked Questions

About the author

Stay up to date with the latest EV news

- Get the latest news and update

- New EV model releases

- Get money savings-deal