With the recent surge in electricity prices (up to 25% since 1 July 2023) and a recent reduction in the price of the Tesla Powerwall 2 battery to $12,900 (inc GST), does it finally make financial sense to buy one?

We are going to answer this question and also cover:

🧮 How Tesla batteries save you money;

💲 Is the Tesla Powerwall 2 worth it; and

🔮 The right time to buy a Tesla Powerwall 2.

How a Tesla Powerwall 2 Battery Saves You Money

How Tesla batteries save you money

Like solar, consumers will have different reasons as to why they'll purchase a battery: energy independence, environmental and financial – with the latter the most difficult to decipher.

Batteries reduce your electricity bill by charging when energy is cheap and discharging when it is expensive. This is known as load shifting.

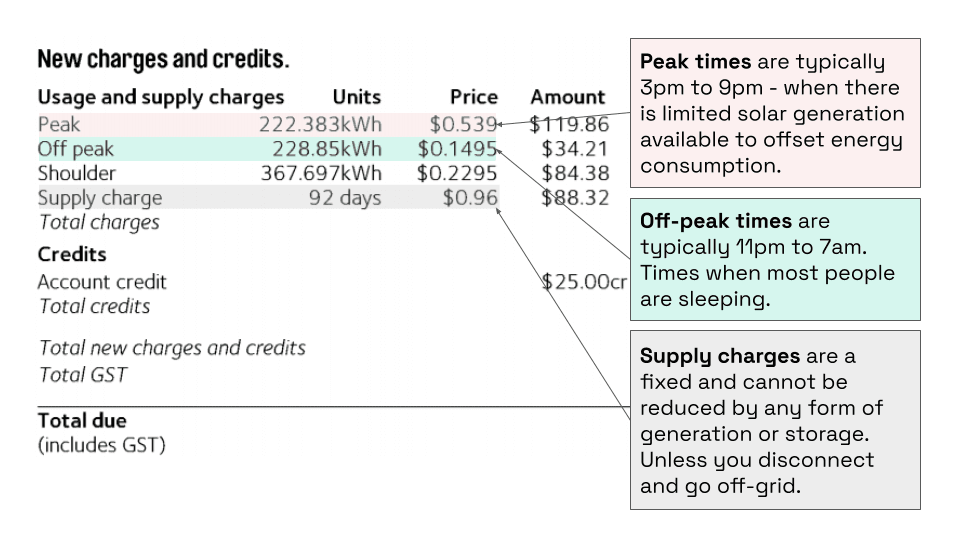

Figure 1 – AGL time of use electricity bill example

To demonstrate how load shifting works, we hopped onto the Energy Made Easy and chose a typical residential electricity time of use tariff plan - AGL's Residential Solar Savers plan (figure 1)

It comprises:

1. Supply charges (cost of getting electricity to your home); and

2. Usage charges (energy you consume).

Usage charges make up the significant majority of your electricity bill and are where solar and batteries have the most impact.

Batteries like the Tesla Powerwall 2 can be configured to charge when energy is cheap (off-peak or via solar which is notionally ‘free’) and discharge when energy is expensive (peak).

The more expensive the energy offset with the lowest cost of charging, the greater the savings. For this reason, flat tariffs are unlikely to make financial sense under nearly any scenario.

The other key consideration when assessing the financial case for Tesla Powerwall 2 battery is the upfront cost.

This is important when assessing the payback period - the number of years for energy savings to repay the cost of the battery.

The case study below will look at the financial case for a solar and Tesla Powerwall 2 battery system by reviewing both the energy savings and total systems costs.

Is a Tesla Powerwall Battery Worth It?

One of the biggest concerns for homeowners considering Tesla batteries is whether or not they are worth the investment. While the upfront cost of a Tesla Powerwall 2 can be high, the energy savings could make it a worthwhile investment.

To illustrate whether a Tesla Powerwall 2 makes financial sense, we’ll look at a customer profile that best reflects:

1. The average energy user; and

2. A common system configuration.

In this case we've modeled the energy consumption (double peak) of a Sydney-based family comprising a working couple and two school-age children.

How a Tesla Powerwall 2 battery works

In this example (figure 3), the Tesla Powerwall 2 employs load shifting to reduce the electricity bill. The battery is primarily charged via solar, with off-peak grid charging used where it was economically sensible. Key ‘qualitative’ benefits generated by the system include the:

- Overall grid energy was reduced by 71% (refer figure 4 below)

- Almost all peak-hour load was eliminated with the remaining load being mainly early morning (off-peak)

- Carbon offset equates to taking 2.2 cars off the road annually

Analysing the financials: cost, savings and returns of a Tesla Powerwall 2

The table below summarises the ideal scenario to maximise the financial case for a Tesla Powerwall 2 battery.

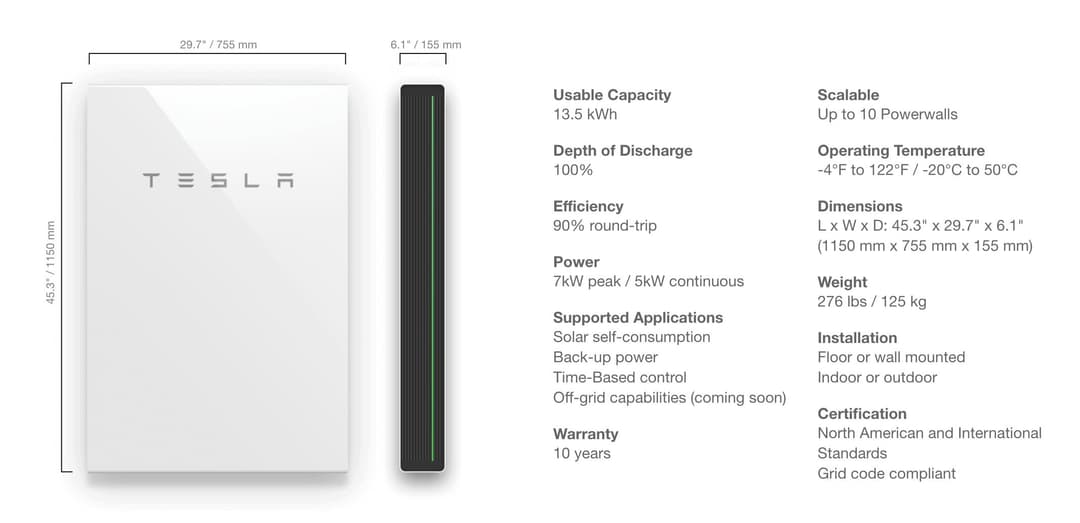

In assessing the financial case we elected to use a typical 7 kW solar system ($6,776 installed) and the 13.5 kWh Tesla Powerwall 2 which retails for $12,900 or $15,000 installed.

The stand-alone solar system is expected to generate ~$1,500 of savings in the first year, resulting in a payback period of 4.4 years (i.e. how long the electricity savings take to repay the upfront cost of the system).

The Tesla Powerwall 2 battery is expected to generate ~$1,100 of savings in the first year, resulting in a payback period of 13.3 years. This falls outside the 10-year warranty period but within the expected 15-year operating life of the Tesla Powerwall 2.

The savings just from the Powerwall 2 will likely be sufficient to recover the initial capital cost within its expected operating life.

As you can see the price of the Powerwall 2 battery is the most significant factor in your return on investment.

Outside of Victoria, no direct government subsidies exist for batteries as they do for electric vehicles.

On a combined basis, when the Tesla Powerwall 2 is purchased with a solar system, the combined annual savings are ~$2,600, resulting in an 8.4 years payback period, well within the 10-year warranty period.

While trending downwards, battery prices are still a fair way off the payback periods (five to seven years), which saw residential solar installations take off.

While the figures in this case study reflect a specific scenario, the analysis will be applicable in many residential use cases.

Higher system consumption, better financial returns

A key driver in maximising the financial returns of any solar and battery system is maximising self-consumption. Higher consumption will result in higher utilisation of the solar and battery system, resulting in higher bill savings and a faster payback period. The converse is true if consumption is lower - payback periods will be longer.

Another way of looking at financial returns

Does the Tesla Powerwall 2 make financial sense? It depends.

Another way of viewing the financial case for batteries is by comparing it to other types of common investments.

On a 'system' basis, the annual returns generated could exceed average annual returns from mortgage rates, shares and property. On a stand-alone basis, the returns from a Tesla Powerwall 2 fall well short.

From the numbers we are seeing, there could be a financial case for refinancing your home to purchase a solar system, batteries, or both!

When viewed from this perspective, the case for purchasing a Tesla Powerwall 2 battery starts to look compelling. The possibility that the Powerwall 2 may not work beyond its warranty period or operational life should not be ignored.

Although the financial case for the Tesla Powerwall 2 is still up for debate, customers are increasingly making decisions on a more holistic basis, including recognising benefits such as backup power (for blackouts and outages) and reducing one’s carbon footprint.

How Much Does a Tesla Powerwall Battery Add to House Value?

How does a Tesla battery increase a home's value?

A Tesla battery system can increase a home's value to the market in three ways:

1. They can substantially reduce a household's annual electricity bill. In the above example, the electricity bill was reduced by almost $2,000 per annum.

2. They can reduce your reliance on the grid and can be set up to provide backup power. The inconvenience and financial cost of a power outage can be significant.

3. Homes with solar battery systems installed will appeal to buyers who are becoming increasingly environmentally conscious. In the previous example, reliance on the grid was reduced by nearly 80%. In a survey conducted by Origin Energy, "57% of homeowners saying they would pay up to $10,000 more for a home equipped with solar, and 60% would pay at least that much more for a home with both".

How much does a Tesla battery add to a home's value?

Research from Domain reveals that the investment often pays off as homes with solar installed are valued on average $125,000 higher than those without. Given the average home solar battery system costs between $15,000 to $20,000, this is another financial reason to consider installing a Tesla battery system.

The Future of Tesla Batteries and Home Energy

Outlook for batteries

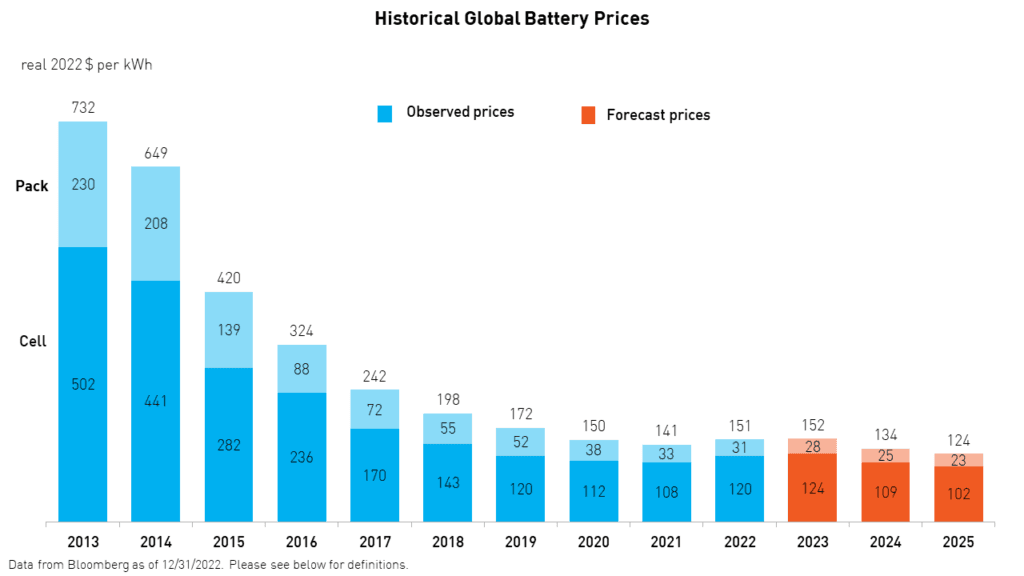

While the financial case for the Tesla Powerwall 2 (and batteries in general) is still up for debate (largely dependent on individual preferences), what is not in doubt is the improving economics – driven by declining costs (solar and batteries) and increasing electricity prices. Battery prices have fallen by as much as 89% in the last decade.

Notwithstanding the staggering reduction in battery prices, the recent explosion in electric vehicle production has resulted in record levels of demand, which battery supply chains have struggled to keep up with. For these reasons, Bloomberg New Energy Finance is forecasting a slight increase in battery prices in 2023, with prices expected to trend down in 2024 and 2025.

Figure 8 – Lithium-ion battery cost forecast

The other key factor to consider is the increasing difference in off-peak and peak energy prices. As more solar generation comes online, this may have the affect of pushing down peak/shoulder energy prices but increasing peak prices (when the sun) isn't shining.

When is the right time to buy a Tesla Powewall 2?

So, when will the financial case for batteries 'stack up' like it does for solar today? We believe it could be soon.

With battery price set to reduce by 25 per cent by 2025, we estimate the same battery will cost $11,990.

This would reduce the payback period (based on the profile of the case study above) of a a combined solar and Powerwall 2 battery system to 8.4 years. Bring prices very close to that 'sweet spot' of 5-7 years.

Emerging alternatives

The consensus is that electric vehicles will not only be the future of transport, but will also play a large role in the future of energy (energy storage and grid services).

The imminent availability of bi-directional charging with EVs enables vehicle to the grid (V2G) services which in turn enable the use of your electric car to function as a battery storage system.

This potentially provides the same utility value as a stationary battery.

Given electric vehicle batteries are three to five times larger than stationary batteries and the fact that cars remain unutilised 95 per cent of the time, it poses the question: would your money be better spent towards an EV?

In future stories, we will explore the emerging utility value of electric cars where they will provide services across transport, energy storage, and the electricity grid.

Frequently Asked Questions

About the author

Stay up to date with the latest EV news

- Get the latest news and update

- New EV model releases

- Get money savings-deal